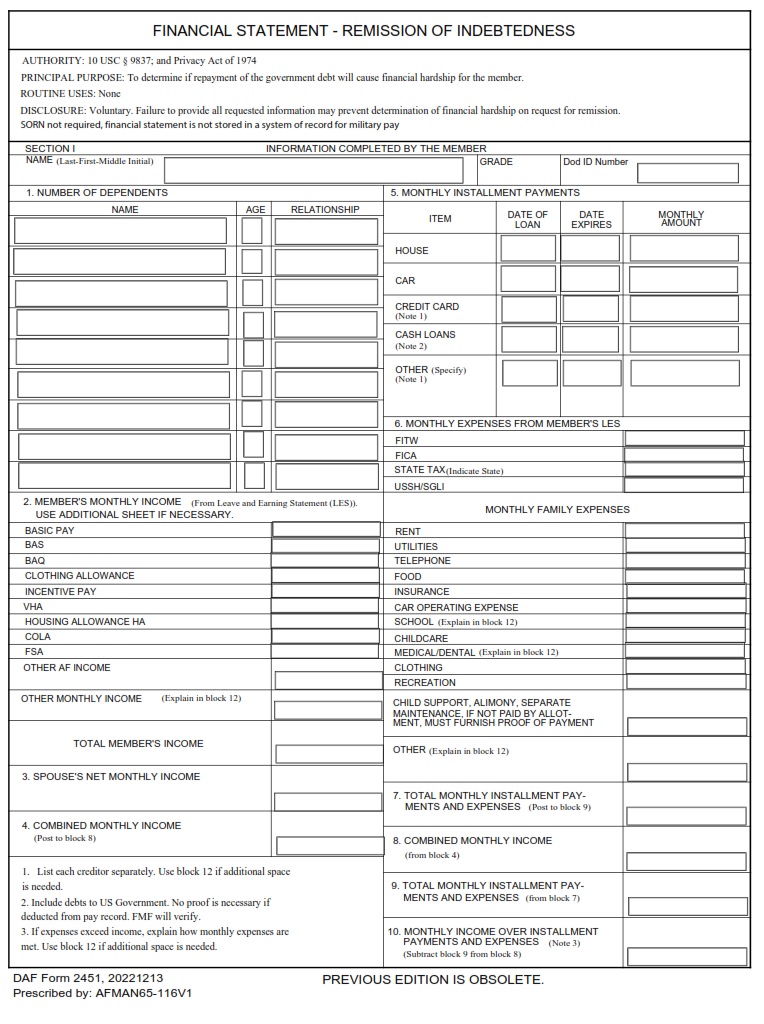

AF-FORMS.COM – DAF Form 2451 – Financial Statement – Remission Of Indebtedness (LRA) – The DAF Form 2451, also known as the Financial Statement – Remission of Indebtedness (LRA), is an important document for any individual or organization that wishes to apply for a remission of indebtedness. It is an essential part of the debt relief process and provides individuals and organizations with a way to request assistance from their creditors in order to reduce or eliminate their financial obligations.

Download DAF Form 2451 – Financial Statement – Remission Of Indebtedness (LRA)

| Form Number | DAF Form 2451 |

| Form Title | Financial Statement – Remission Of Indebtedness (LRA) |

| Edition Date | 12/13/2022 |

| File Size | 1 MB |

DAF-Form-2451-Financial-Statement-Remission-Of-Indebtedness-LRA.pdf (46 downloads )

What is a DAF Form 2451?

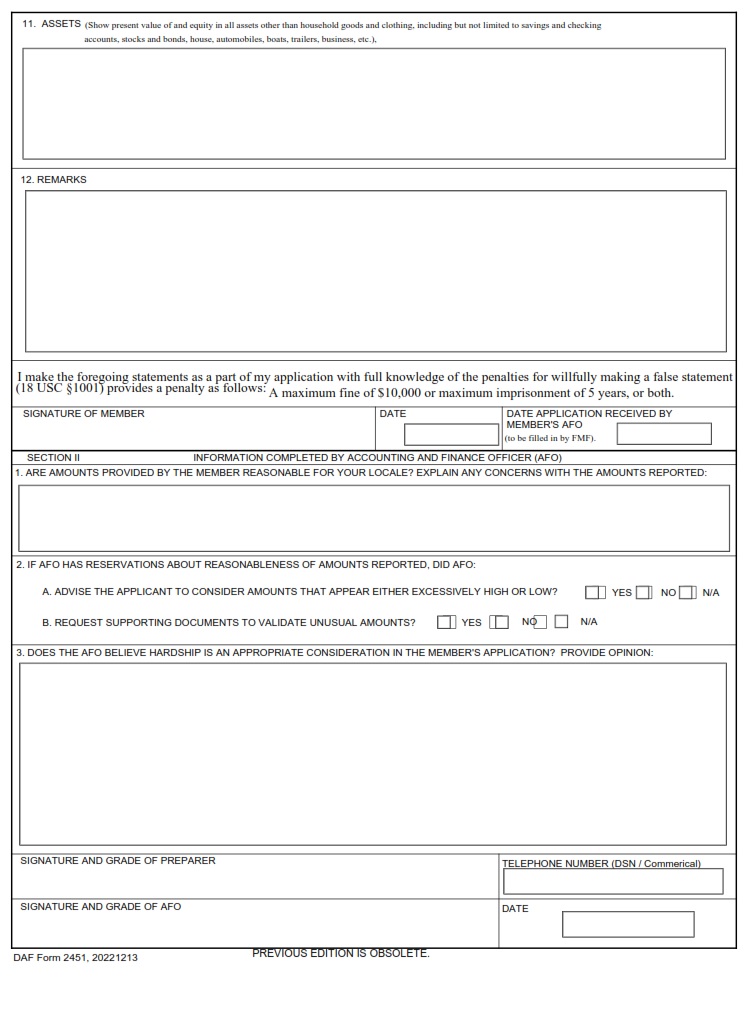

DAF Form 2451 is a form issued by the Legal Remedies Authority (LRA) in order to collect information about a debtor’s financial situation. The form collects information regarding the debtor’s assets and liabilities, income, expenses, and other factors that may affect the individual’s ability to repay their debts. It also requests details of any security offered for the debt and any potential arrangements for repayment. By completing this form, an individual can provide evidence of their current financial situation to the LRA so that a decision can be made on whether or not they are eligible for remission of their indebtedness. This could potentially result in reduced monthly payments or even complete forgiveness of all or part of the debt owed. The DAF Form 2451 must be completed accurately and truthfully in order for it to be accepted by the LRA. Failure to accurately disclose all relevant financial information could result in the rejection of an application or criminal charges being brought against an individual if they are found to have deliberately provided false information on their application.

Where Can I Find a DAF Form 2451?

DAF Form 2451 is available online from the Louisiana Department of Revenue’s website. It can be found by searching for ‘DAF 2451’ or by navigating to the Forms and Publications page and selecting ‘Income Tax – Financial Statement’. The form can also be requested in paper format by contacting the department’s Customer Service line at 504-934-0752. When filling out DAF Form 2451, taxpayers will need to provide their Social Security Number, name, address, phone number, and any other applicable details in order to complete the form. Additionally, they will need to list all sources of income received since January 1st of that tax year as well as any debts paid during that time period. Once filled out correctly it should be mailed with supporting documents such as a copy of the 1040 or 1040A form to the Louisiana Department of Revenue – LRA PO Box 9599 Baton Rouge LA 70821-9599. Once submitted, taxpayers should receive notification within 3 weeks on whether or not their request for remission has been approved or denied.

DAF Form 2451 – Financial Statement – Remission Of Indebtedness (LRA)

DAF Form 2451, Financial Statement – Remission of Indebtedness (LRA), is a form used to provide the Local Revenue Authority (LRA) with financial information related to the remission of an indebtedness. It provides details on the amount being remitted and the reason for remission in order to be approved. The form must include all relevant data such as the name of the debtor, the address of the debtor, and other pertinent particulars. Additionally, it should include evidence that supports why remission is necessary, with accompanying documents such as certified copies of invoices or contracts. Once all information has been provided accurately, a signed copy must be submitted to the LRA for approval.

The approval process can take several weeks and if any information is missing or incorrect on the form then it may delay processing times significantly. Therefore, preparation is key before submitting DAF Form 2451 and all conditions outlined by the LRA should be met beforehand in order to ensure a smooth process. Furthermore, all documentation submitted should correspond with what was initially declared on DAF Form 2451 in order for any financial claim related to the remission of debt to be successful. If any discrepancies are found once reviewed by an LRA auditor then further investigation may take place which could lead to possible penalties or fines imposed on those involved with the submission of this particular document.