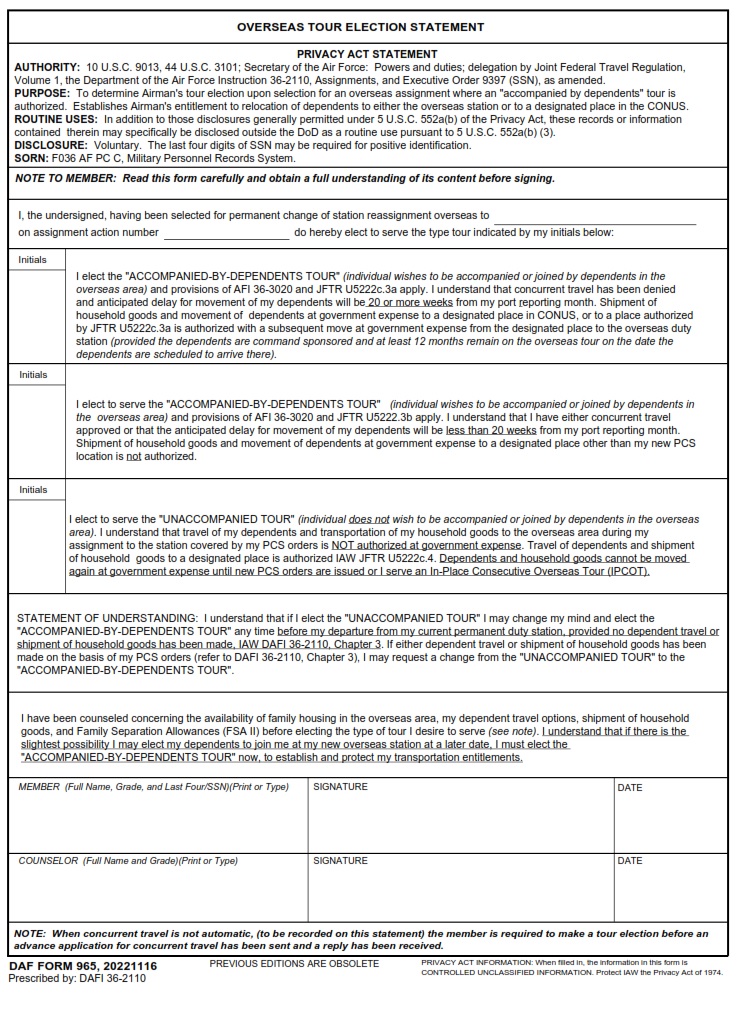

AF-FORMS.COM – DAF Form 965 – Overseas Tour Election Statement – The Department of the Army Form (DAF) 965 is an important document that allows members of the United States military stationed overseas to make elections concerning their current tour. This statement is used to inform the tax office that the service member has elected certain taxation options, such as combat zone exclusion or foreign-earned income exclusion. It also provides important information about their dependents and other tax-related details.

Download DAF Form 965 – Overseas Tour Election Statement

| Form Number | DAF Form 965 |

| Form Title | Overseas Tour Election Statement |

| Edition Date | 11/16/2022 |

| File Size | 36 KB |

DAF-Form-965-Overseas-Tour-Election-Statement.pdf (68 downloads )

What is a DAF Form 965?

DAF Form 965 is a tax form used by members of the United States Armed Forces (USAF) who are on an overseas tour duty assignment. It allows such individuals to elect to claim the higher standard deduction allowed for those on overseas tour duty, rather than itemizing deductions. The election is made in accordance with Section 911 of the Internal Revenue Code and applies only to income earned from sources within a foreign country or U.S. possession.

A DAF Form 965 must be filed for every year that an individual claims the higher standard deduction due to their overseas tour status. It should be attached to one’s original federal income tax return and must contain information about their current location, current job title, dates of residence in a foreign country or U.S. possession, and other details as necessary for IRS auditors to verify eligibility for this special deduction status. Additionally, if filing jointly with one’s spouse while they are both claiming the section 911 exclusion then both parties must sign and complete separate copies of this form, even if they are filing under the same address and using joint financial accounts.

Where Can I Find a DAF Form 965?

DAF Form 965, also known as the Overseas Tour Election Statement, is a form used by members of the U.S. Armed Forces who are on temporary duty outside the United States and its territories to determine their tax liability while they are away from their permanent duty station. This form can be submitted to the Internal Revenue Service (IRS) to help calculate the correct tax rate for a member’s overseas tour of duty. The form is available online at IRS.gov or can be obtained from an overseas military installation’s finance office or personnel office. Members may also request DAF Form 965 from their local Tax Assistance Center or Military OneSource office. Additionally, many software packages used for filing taxes have this form available within them as well as through various online portals such as TurboTax and H&R Block. Lastly, service members can contact their legal assistance officer for advice regarding DAF Form 965 and other tax-related issues while deployed abroad.

DAF Form 965 – Overseas Tour Election Statement

The DAF Form 965, also known as the Overseas Tour Election Statement, is a document used by US military personnel who are being assigned to or returning from an overseas tour of duty. This form allows members of the armed forces to elect whether they would like to defer their earned income and other entitlements while on active duty outside of the United States. The form outlines two types of deferrals: one that applies to basic pay and special pay, and another that applies to combat zone tax exclusion payments. It also provides information about how these deferrals can be applied, including what documents need to be filed with the IRS in order for them to take effect. Additionally, it includes instructions for completing the form correctly and filing it with the appropriate authorities upon return from overseas deployment. In summary, DAF Form 965 serves an important purpose for those in active service who wish to minimize their tax burden during their time away from home.