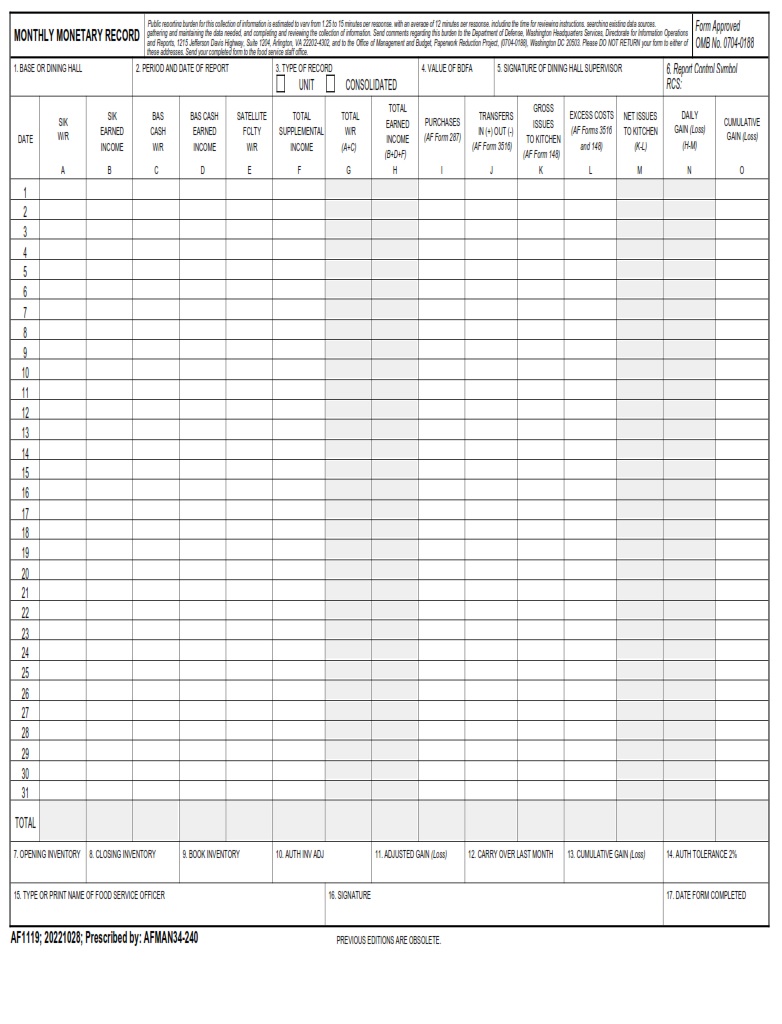

AF-FORMS.COM – DAF Form 1119 – Monthly Monetary Records – The Department of Administrative Finance (DAF) Form 1119 is an important document used to track and record monthly monetary transactions. This form provides a comprehensive overview of all financial activity occurring within an organization, enabling accurate tracking of income and expenses. The goal of this article is to provide an in-depth explanation of the DAF Form 1119, including its purpose, structure, and how it contributes to effective financial record keeping.

Download DAF Form 1119 – Monthly Monetary Records

| Form Number | DAF Form 1119 – Monthly Monetary Records |

| Form Title | |

| Edition Date | 10/28/2022 |

| File Size | 60 KB |

What is a DAF Form 1119?

DAF Form 1119 is a form used by the Department of Agriculture and Fisheries (DAF) to document expenses related to recreational fishing. It is a monthly record of all financial transactions made in relation to the purchase, maintenance, or other costs associated with recreational fishing activities. The form contains five columns: date, the amount received or paid out, type of transaction (e.g., purchase or repair), purpose/description of the transaction, and the total cost incurred/received for the month. The information collected on this form helps DAF ensure compliance with regulations pertaining to recreational fishing activities in Queensland. Additionally, it provides an efficient way for DAF to monitor expenditures and track any changes that may occur over time due to new regulations or changes in budgets associated with fisheries management plans.

Where Can I Find a DAF Form 1119?

DAF Form 1119 is used by the Department of Agriculture and Fisheries (DAF) to keep track of monthly monetary records. This form can be found on the website of the DAF or at any local government office where agricultural or fisheries activities are monitored. If you are unable to find it online, you can also contact your local government office to request a paper copy of the form.

When completing a DAF Form 1119, you must include all information related to transactions that involve money, such as payments made and received, loans taken out and repaid, sales made, purchases made, and other financial dealings related to agriculture or fisheries activities. This form must be filled out in detail with accurate information in order for it to be accepted by DAF authorities for review and audit purposes. You should also make sure that all relevant documents are included with the form when submitting it for processing.

Finally, once completed, the DAF Form 1119 needs to be submitted along with any other required forms or documents within 30 days after each month’s end date for review and evaluation by DAF authorities. It is important to note that failure to do so may result in fines or penalties being imposed on those responsible for not filing their forms properly.

DAF Form 1119 – Monthly Monetary Records

DAF Form 1119 – Monthly Monetary Records is a form used by the Department of Agriculture and Fisheries (DAF) in order to monitor, evaluate and document its financial operations. The form contains information about the cash flow for each month, as well as any changes to the monthly budget. It is important for DAF to keep track of these records in order to ensure that their financial activities are properly monitored and reported.

The form includes sections for recording income, expenses, assets, and liabilities. This allows DAF to have an accurate picture of its financial position each month. Additionally, it also enables them to review trends over time in order to make adjustments if necessary. By providing this level of detail, the form helps DAF maintain accurate records which can be used for planning purposes or evaluating performance against budgets.

Finally, the form also provides additional data points such as interest rates charged on loans or investments made by DAF during the month. This allows them to gain valuable insight into how their money is being managed which can be useful when it comes time to make decisions about future investments or other financial matters related to their organization.