AF-FORMS.COM – AF Form 645 – Cash Register Adjustment – In the fast-paced world of military operations, precision and accuracy are paramount. Imagine a scenario where every dollar counts, where meticulous record-keeping is not just a suggestion but a necessity. Enter AF Form 645 – Cash Register Adjustment, a document that holds the key to maintaining financial integrity within the United States Air Force. This seemingly mundane form may appear insignificant at first glance, but its implications run deep, affecting everything from daily transactions to overall budget management strategies.

At the heart of every cash register adjustment lies a tale of scrutiny and accountability. Picture an airman diligently filling out this form, tracing discrepancies in cash balances with unwavering attention to detail. The stakes are high as each entry could reveal potential errors or even fraudulent activities. By exploring the nuances of AF Form 645, we unravel not just numbers on paper but also uncover the intricate mechanisms put in place to safeguard financial resources in one of the most disciplined forces in the world. Join us as we delve into this obscure yet essential aspect of Air Force finance and discover why even minor adjustments can make a significant impact on mission success.

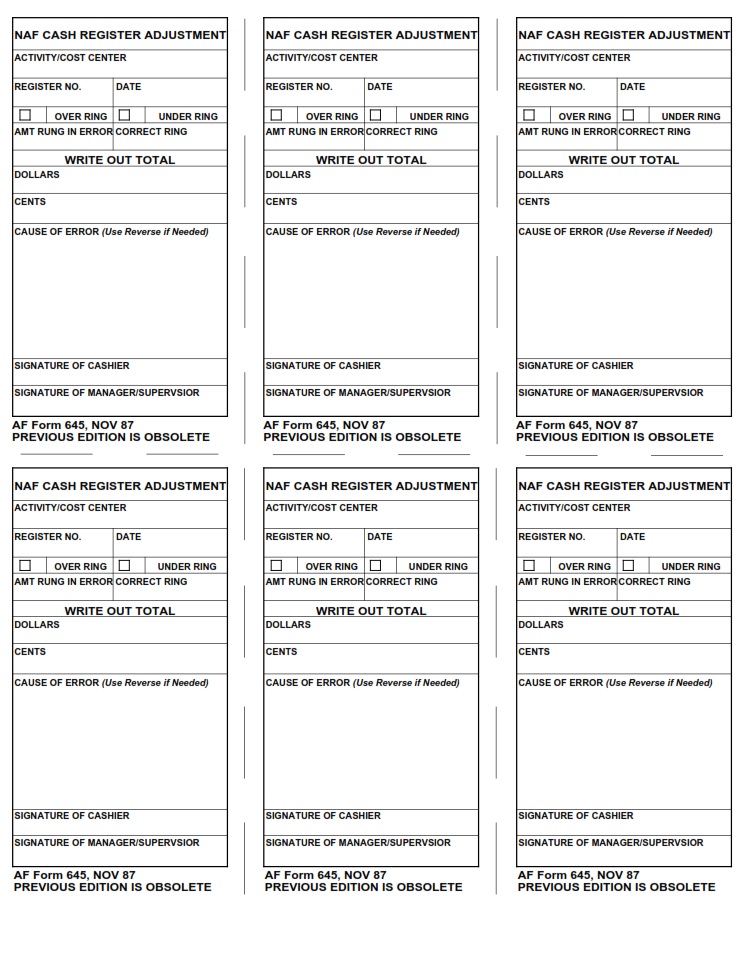

Download AF Form 645 – Cash Register Adjustment

| Form Number | AF Form 645 |

| Form Title | Cash Register Adjustment |

| Edition Date | 11/1/1987 |

| File Size | 30 KB |

AF-Form-645-Cash-Register-Adjustment.pdf (31 downloads )

What is an AF Form 645?

An AF Form 645 is a vital document used by the United States Air Force for cash register adjustments. This form serves as a record of any discrepancies or corrections made in the system, ensuring transparency and accountability in financial transactions. It plays a crucial role in maintaining accurate accounting practices within Air Force establishments.

When it comes to cash register adjustments, precision and efficiency are key factors. The AF Form 645 helps streamline this process by providing clear guidelines for documenting any errors or alterations. By utilizing this form properly, the Air Force can uphold high standards of fiscal responsibility while enhancing overall operational effectiveness.

Where Can I Find an AF Form 645?

When it comes to finding an AF Form 645, the process may initially seem daunting for individuals who are not familiar with military paperwork. The Air Force Forms Management office website is a reliable source for accessing official forms, including the AF Form 645. This form is typically used by personnel responsible for making cash register adjustments within Air Force operations, serving as a crucial tool for maintaining accurate financial records.

Additionally, individuals can reach out to their unit’s designated forms manager or administrative personnel to obtain a copy of the AF Form 645. These individuals are well-versed in navigating through the various forms required within Air Force procedures and can provide guidance on where to find and how to properly fill out the necessary paperwork. Taking proactive steps to locate the AF Form 645 demonstrates professionalism and attention to detail in handling financial transactions within military settings.

AF Form 645 – Cash Register Adjustment

When it comes to handling financial transactions in the military, precision and accuracy are paramount. The AF Form 645, also known as the Cash Register Adjustment form, plays a crucial role in ensuring that any discrepancies in cash register balances are properly documented and reconciled. This form serves as a vital tool for military personnel responsible for managing cash transactions, helping to maintain accountability and transparency in financial operations.

One key aspect of the AF Form 645 is its role in providing a clear paper trail of any adjustments made to cash register balances. By accurately documenting the reasons for adjustments, such as errors or discrepancies, this form helps maintain integrity and accountability within financial systems. Additionally, by requiring proper authorization and verification of adjustments, the AF Form 645 helps prevent potential misuse or fraud, safeguarding financial resources and maintaining trust in the system.

AF Form 645 Example