AF-FORMS.COM – AF Form 2556 – Naf Surprise Or General Cashier’s Cash Count – Have you ever wondered about the mysterious world of military finance and accounting? In the realm of Air Force financial operations, there exists a form that holds a unique intrigue – the AF Form 2556. Often referred to as the NAF Surprise or General Cashier’s Cash Count, this document plays a crucial role in ensuring transparency and accountability within Air Force Non-Appropriated Fund (NAF) activities. While its name may sound enigmatic, delving into the details of this form unveils a fascinating system designed to safeguard financial resources and prevent discrepancies. Join us on a journey through the intricacies of military cash management as we uncover the significance and purpose behind AF Form 2556.

From hidden cash vaults to meticulous counting procedures, the world of military cash handling is shrouded in protocols and safeguards aimed at upholding financial integrity. The AF Form 2556 serves as a pivotal tool in this intricate system, requiring designated personnel to conduct surprise cash counts at various intervals to verify the accuracy of funds held by General Cashiers. Beyond just numbers on paper, these counts represent a critical aspect of maintaining trust and reliability within Air Force financial operations. So buckle up as we unravel the mysteries behind this seemingly mundane yet essential form that plays a vital role in preserving fiscal responsibility within the military domain.

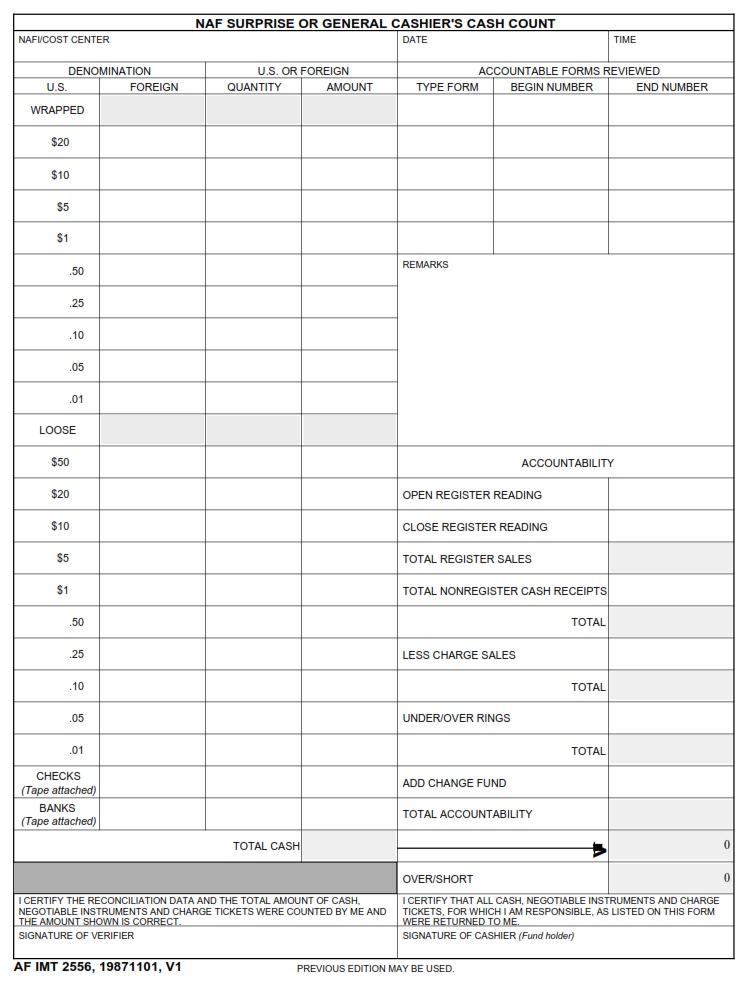

Download AF Form 2556 – Naf Surprise Or General Cashier’s Cash Count

| Form Number | AF Form 2556 |

| Form Title | Naf Surprise Or General Cashier’s Cash Count |

| Edition Date | 11/1/1987 |

| File Size | 22 KB |

AF-Form-2556-NAF-Surprise-Or-General-Cashiers-Cash-Count.pdf (98 downloads )

What is an AF Form 2556?

The AF Form 2556, often referred to as the General Cashier’s Cash Count form, is a critical document used in financial operations within the United States Air Force. This form is essential for auditing and tracking cash transactions within nonappropriated fund (NAF) activities. It serves as a record of daily cash counts and helps ensure accountability and transparency in financial processes. The detailed information provided on the AF Form 2556 allows for thorough monitoring of cash handling practices, reducing the risk of errors or misuse.

One interesting aspect of the AF Form 2556 is its dual role in enhancing efficiency and promoting financial integrity. By meticulously documenting cash transactions and reconciling discrepancies, this form facilitates effective management of NAF funds while also fostering a culture of responsibility among personnel involved in monetary operations. Furthermore, regular use of this form not only safeguards against potential fraud but also demonstrates the Air Force’s commitment to upholding high standards of financial stewardship. Overall, the AF Form 2556 stands as a testament to the importance placed on sound fiscal practices within military organizations like the US Air Force.

Where Can I Find an AF Form 2556?

If you are searching for an AF Form 2556, look no further than your local financial office on a military installation. These forms, also known as General Cashier’s Cash Count sheets, are typically available in the finance or accounting department where cash transactions and reconciliations take place. It is important to familiarize yourself with the specific location and personnel responsible for distributing these forms to ensure timely compliance with financial procedures.

Additionally, some military organizations may have digital repositories or online portals where personnel can access and download various forms, including the AF Form 2556. Checking with your unit’s administrative staff or financial management office can provide valuable insights into streamlined processes for obtaining necessary documentation. Remember to always adhere to proper protocols and guidelines when handling cash transactions in a military setting to maintain accountability and transparency in financial operations.

AF Form 2556 – Naf Surprise Or General Cashier’s Cash Count

Today, let’s dive into the intriguing world of AF Form 2556 – the NAF Surprise or General Cashier’s Cash Count. This form plays a crucial role in ensuring financial accountability and transparency within military organizations. It serves as a tool for verifying that cash on hand matches recorded amounts, safeguarding against discrepancies and potential financial mismanagement.

The meticulous process of filling out AF Form 2556 requires attention to detail and strict adherence to regulations. By conducting regular surprise cash counts or cashier’s cash counts using this form, military units can uphold strict financial controls and prevent any unauthorized use of funds. Ultimately, the use of AF Form 2556 contributes to maintaining trust and integrity in financial operations within the military, fostering a culture of responsibility and accountability among personnel involved in handling cash transactions.

AF Form 2556 Example