AF-FORMS.COM – AF Form 2555 – Naf Collection Record – In the world of military finance, meticulous record-keeping is not just a formality; it is a critical component of ensuring financial accountability and transparency. One such document that plays a vital role in this realm is the AF Form 2555 – Naf Collection Record. This seemingly mundane piece of paperwork holds within its fields a treasure trove of information that paints a detailed picture of non-appropriated fund (NAF) collections within an Air Force unit. From tracking revenues generated by on-base recreational facilities to monitoring sales at morale-boosting events, the AF Form 2555 serves as a silent sentinel, guarding against financial discrepancies and ensuring that every dollar earned is accounted for.

As you delve into the world of the AF Form 2555, you will uncover not just numbers and figures but also stories of dedication, hard work, and ingenuity displayed by military personnel tasked with managing NAF resources. Each entry on this form represents more than just money collected; it symbolizes the collective effort put forth by service members to enhance the quality of life for themselves and their comrades-in-arms. So join us as we embark on a journey through the intricate web of NAF collections, where every line tells a story and every total reflects a commitment to excellence in financial stewardship within the U.S. Air Force community.

Download AF Form 2555 – Naf Collection Record

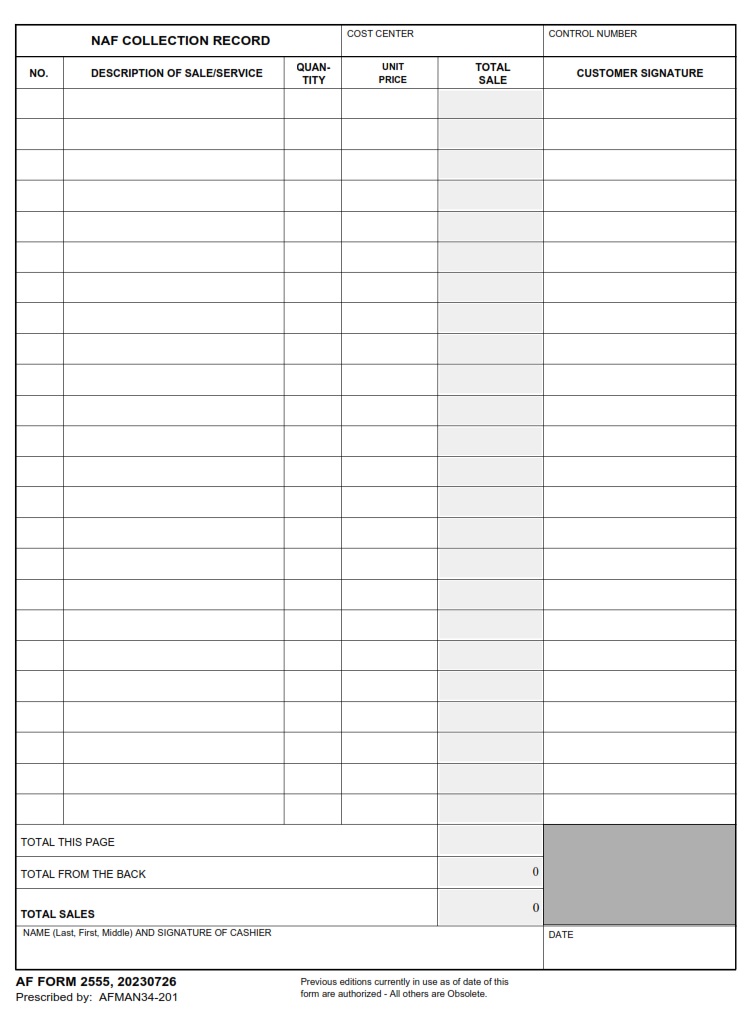

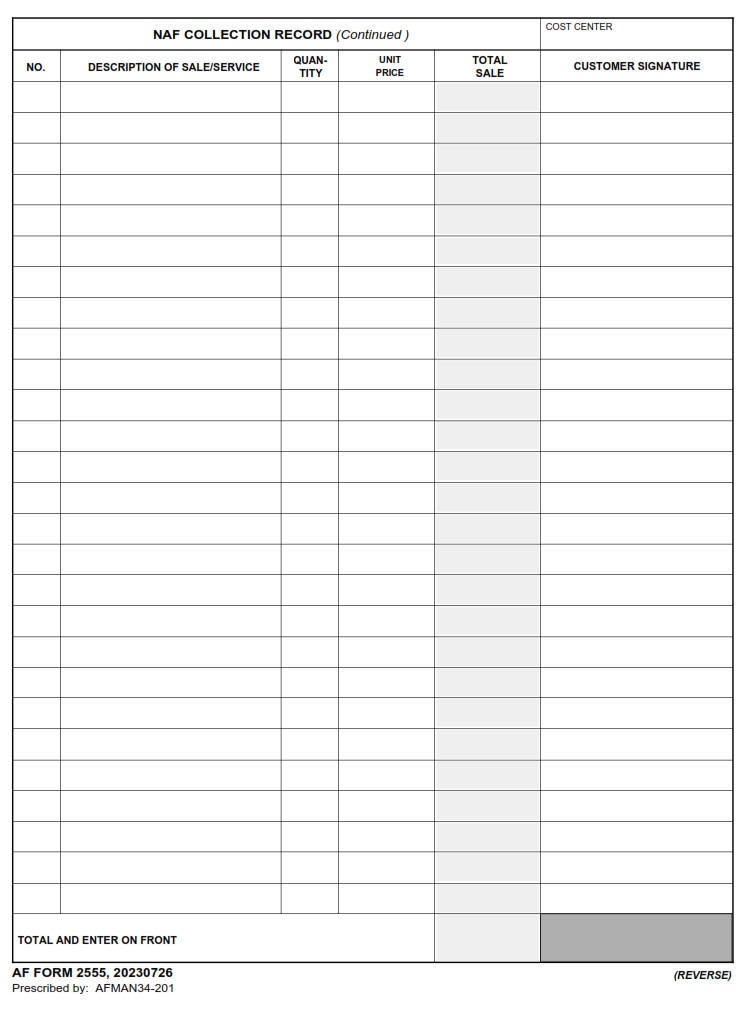

| Form Number | AF Form 2555 |

| Form Title | Naf Collection Record |

| Edition Date | 11/1/1987 |

| File Size | 54 KB |

AF-Form-2555-NAF-Collection-Record.pdf (264 downloads )

What is an AF Form 2555?

The AF Form 2555, also known as the Naf Collection Record, plays a crucial role in documenting and tracking non-appropriated fund (NAF) transactions within the Air Force community. This form serves as a detailed record of all financial activities related to NAF funds, ensuring transparency and accountability in the management of these resources. By accurately completing and maintaining the AF Form 2555, personnel can easily track expenditures, revenue sources, and other financial data essential for decision-making processes.

Moreover, proper utilization of the AF Form 2555 helps institutions comply with financial regulations and guidelines governing NAF operations. The meticulous recording of income sources, expenses, and asset acquisitions on this form enables organizations to monitor their financial health effectively. It also provides a comprehensive overview of how NAF funds are being utilized across different departments within the Air Force structure. In essence, the AF Form 2555 acts as a vital tool in promoting financial integrity and stewardship within military organizations by establishing clear documentation procedures for NAF transactions.

Where Can I Find an AF Form 2555?

If you are in search of an AF Form 2555, commonly known as the ‘Naf Collection Record,’ there are several avenues you can explore to locate this specific document. One of the most convenient ways to access this form is through the official website of the United States Air Force. By visiting their website and navigating to the Forms section, you should be able to find and download a copy of AF Form 2555 with ease.

Additionally, military personnel may also have access to this form through internal databases or resources provided by their respective unit or organization. It is recommended that you reach out to your commanding officer or administrative staff for guidance on where to obtain an AF Form 2555 if needed urgently. In cases where online resources are not feasible, physical copies may also be available at designated military installations or bases.

AF Form 2555 – Naf Collection Record

The AF Form 2555, also known as the NAF Collection Record, is a vital document utilized by non-appropriated fund (NAF) organizations to accurately track and record financial transactions. This form plays a crucial role in maintaining fiscal accountability within these organizations by documenting details such as amounts collected, transaction dates, and types of payments received. It serves as a comprehensive tool for monitoring revenue streams and ensuring compliance with financial regulations.

One key aspect of the AF Form 2555 is its ability to provide transparency and visibility into the financial operations of NAF entities. By meticulously documenting all collections made by these organizations, the form enables stakeholders to assess performance metrics, identify trends, and make informed decisions regarding resource allocation. Additionally, this record serves as a valuable asset during audits or reviews, offering concrete evidence of financial transactions and promoting accountability at all levels.

In essence, the AF Form 2555 serves as a cornerstone for effective financial management within NAF organizations. Its meticulous documentation practices ensure accuracy in recording collections and expenditures while fostering transparency and accountability throughout the organization’s fiscal operations. By leveraging this form as a tool for data analysis and decision-making, NAF entities can optimize their revenue streams, enhance operational efficiency, and maintain compliance with regulatory requirements.