AF-FORMS.COM – AF Form 262 – Naf Financial Statement Analysis – Are you tired of drowning in a sea of numbers and financial jargon? Do you find yourself struggling to make sense of the AF Form 262 – Naf Financial Statement Analysis? Fear not, as this article is here to guide you through the labyrinth of financial data and help unravel the mysteries hidden within those spreadsheets. Whether you’re a seasoned finance professional or a newcomer to the world of financial statements, this comprehensive analysis will provide valuable insights and practical tips to navigate through the complexities of NAF finances.

Delve deep into the intricate web of financial information contained within the AF Form 262, as we decode its significance and unearth key trends that can drive informed decision-making. From analyzing revenue streams to scrutinizing expense allocations, this article will equip you with the tools needed to conduct a thorough evaluation of your organization’s financial health. So buckle up and get ready for an enlightening journey into the realm of NAF Financial Statement Analysis!

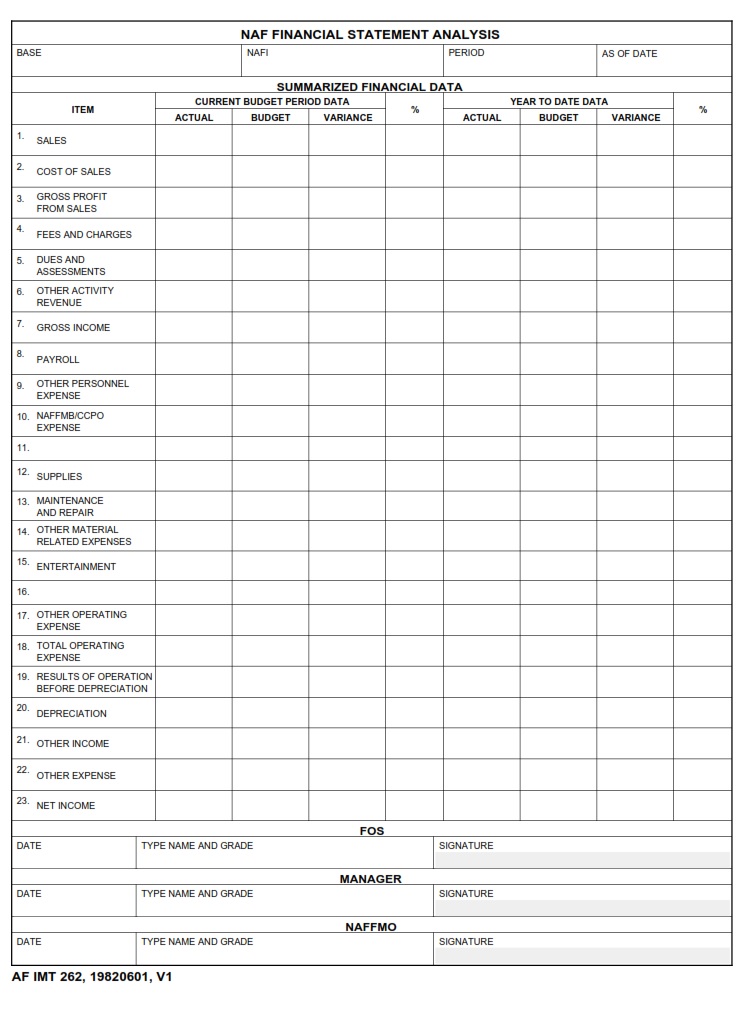

Download AF Form 262 – Naf Financial Statement Analysis

| Form Number | AF Form 262 |

| Form Title | Naf Financial Statement Analysis |

| Edition Date | 6/1/1982 |

| File Size | 23 KB |

AF-Form-262-Naf-Financial-Statement-Analysis.pdf (24 downloads )

What is an AF Form 262?

The AF Form 262, also known as the NAF Financial Statement Analysis form, plays a crucial role in assessing financial performance and accountability within the Air Force. This form serves as a tool for evaluating Non-Appropriated Fund (NAF) organizations by analyzing their revenues, expenses, assets, and liabilities. Through this analysis, key stakeholders can gain valuable insights into the fiscal health and operational efficiency of these entities.

By delving into the details of an AF Form 262, decision-makers can identify trends, risks, and opportunities that may impact resource management strategies. The data provided in this form empowers leaders to make informed financial decisions, allocate resources effectively, and drive organizational success. Utilizing the information from AF Form 262 allows for transparency and accountability in financial reporting processes within NAF organizations.

Where Can I Find an AF Form 262?

When looking for an AF Form 262, it’s essential to know where to find this crucial document for NAF financial statement analysis. One primary source to obtain the form is through official Air Force channels, such as Air Force Financial Management offices or online platforms like the Air Force e-Publishing website. These resources offer up-to-date versions of the AF Form 262 and provide detailed instructions on how to fill it out accurately.

Additionally, reaching out to your local base finance office can be a valuable way to acquire a copy of the AF Form 262. Finance professionals at these offices are well-equipped to assist with any questions related to NAF financial statements and can guide you in obtaining the necessary paperwork promptly. By leveraging these various channels, individuals and organizations can ensure they have access to the latest version of AF Form 262 for comprehensive financial statement analysis purposes.

AF Form 262 – Naf Financial Statement Analysis

When it comes to NAF financial statement analysis, AF Form 262 plays a crucial role in providing a comprehensive overview of an organization’s financial health. By examining various aspects such as revenue sources, expenses, and balance sheet information, this form enables analysts to dig deep into the financial performance of NAF entities. Moreover, understanding the data presented on AF Form 262 can help decision-makers make informed choices regarding resource allocation and strategic planning within the non-appropriated fund.

One key aspect to focus on when analyzing AF Form 262 is the trend analysis of financial indicators over time. By comparing current financial data with historical figures, analysts can identify patterns, anomalies, and potential areas for improvement or concern. This systematic approach allows for a more thorough evaluation of an organization’s financial position and performance trajectory. Additionally, leveraging tools like ratio analysis can provide valuable insights into liquidity, profitability, and overall operational efficiency that go beyond what is initially presented in the form itself.

AF Form 262 Example